Navigating today’s dynamic financial markets demands more than just speed; it requires precise control, driven by actionable data. To truly thrive, it’s paramount for trading firms to have a comprehensive understanding of their entire trade execution lifecycle, transforming complex streams of data into clear, actionable insights.

Why Full Cycle Analytics? The Imperative for Control

In a landscape where market microstructures evolve by the day, fragmented data and a lack of real-time visibility can lead to inefficiencies and missed opportunities. Traditional approaches often leave gaps in understanding, making it difficult to pinpoint exactly where performance is gained or lost.

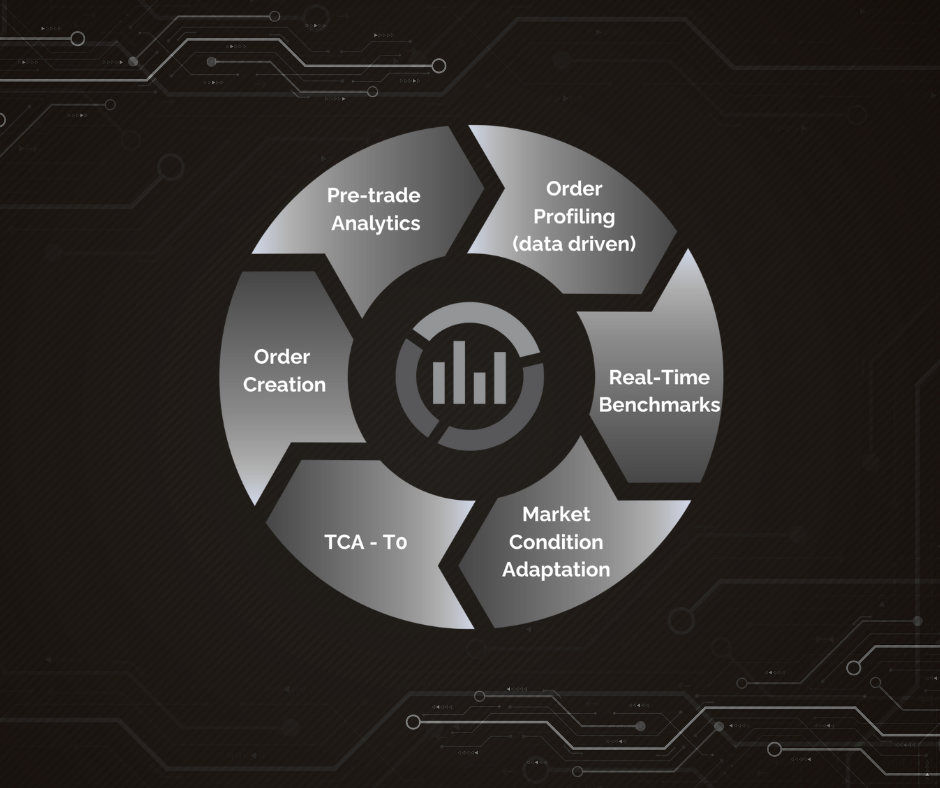

This is where full cycle execution order analysis becomes indispensable. It provides an end-to-end perspective, allowing you to track and optimize an order from its inception to its final execution and beyond.

The Full Cycle Process:

- Pre-Trade Analytics: Initial analysis, optimal algo selection, and parameter setting.

- Dynamic Routing: Orders sent, optimal execution channel selection.

- Algo Monitoring: Adjustments based on real-time market changes.

- Market Condition Adaptation: Tracking fills, progress, and alerts.

- Performance benchmarking: Performance comparison, safety controls.

- Post-trade TCA Report: Order details and post-trade analysis reporting.

Our solutions provide precisely this comprehensive view, from pre-trade insights through real-time monitoring and crucial post-trade review. This empowers you to understand exactly how your strategies perform, benchmark against fluctuating market conditions, and make real-time adjustments.

Why Are Analytics & Monitoring Features Important

At the heart of this comprehensive understanding lies our robust analytics engine and intuitive algo monitoring. These tools work in tandem to deliver deep insights into algo configurations, track fill progress, and alert you instantly to deviations, ensuring unparalleled transparency and control. You gain immediate access to order details and real-time benchmarks, enabling granular performance analysis.

Our Core Analytical & Monitoring Capabilities:

- Real-Time Algo Monitoring & Immediate Alerts

- Precision Performance Benchmarking

- Visibility into Realized vs. Predicted Trade Schedules

- Leverage of Custom & Off-the-Shelf Indicators

- Comprehensive Algo & Strategy Benchmarking

Deep Dive into Execution

Beyond broad insights, gaining granular control over every aspect of execution is crucial. Our Execution View provides a dedicated, algo-flow specific interface built for advanced benchmarking, precise algo control, and dynamic risk management. It offers a holistic, low-touch order management experience, providing integrated access to our comprehensive Algo Suite through a single login.

Easily access the Order Details screen for in-depth insights into any algo order’s performance. Whether it’s a scheduled or volume-driven algorithm, you can examine order life, detailed data, benchmark performance, user parameters, and backend configuration, including historical VWAP profiles and schedules for scheduled algos.

To continuously refine execution quality, we integrate dynamic routing and advanced Transaction Cost Analysis (TCA) tools. This delivers sharper insights and faster, more informed trading decisions.

Key Features:

- Customizable Reporting: Tailor your analysis by filtering across date ranges, specific algorithms, clients, exchanges, and minimum traded value.

- Comprehensive Insights: Reports include summaries, histograms, and highlights of high-cost and best-performing orders.

- Easy Access: Generate reports directly from the toolbar with user-friendly controls.

- Seamless Integration: Easily integrate with existing OMS/EMS platforms and generate on-demand reports for real-time decision-making.

Conclusion

In an increasingly competitive landscape, relying on intuition or fragmented data is no longer sufficient. Embracing full cycle analytics provides the clarity, control, and insights needed to continuously optimize your trading strategies, manage risk effectively, and ultimately secure a decisive competitive edge.

Schedule a demo to see our solution in action, or contact our experts for more information.