Market Making REQUEST A DEMO GET IN TOUCH

Continually manages inventory in all market conditions while allowing bid/ask spread control across multiple asset classes.

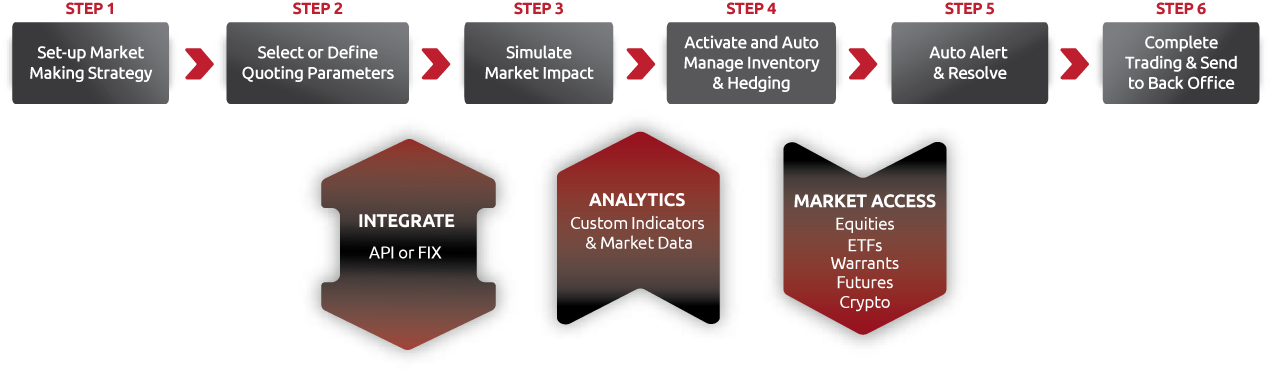

Supported by a robust analytics engine, users can leverage any custom indicator for quoting or hedging purposes – such as NAVs, theoretical prices generated using various pricing models, etc. It enables users to choose between manual quoting and complete automated smart pegging while allowing them to visually simulate the market impact the strategy release will cause.

Complete all your market making activities and leverage our program trading platform for quick inventory management, unit redemption, or unit creation.

KEY BENEFITS:

- Molds seamlessly into any peculiar market making workflow

- Allows users to optimize their screens by only accessing parameters that are key to their quoting and hedging strategy

- Easy control and reduction of market risk

- Allows users to complete all market making activities on their desired asset-classes dependent on the underlying instruments

KEY FEATURES:

- Quote Control

- Quote Simulation

- Strategy Configuration

- Manual and Automated

- Auto Hedging

- Risk Management

- Performance Monitoring

- Leverage Click Trading

REQUEST A DEMO GET IN TOUCH