Trading desks today face increasing pressure to reduce costs, adapt quickly, and navigate evolving market structures. Yet many still operate on disconnected systems that limit flexibility and slow execution.

The Problem

Managing fragmented connectivity and complex strategies across diverse markets is a major challenge. Disjointed systems slow execution, increase operational overhead, and limit the ability to respond to real-time market conditions. Inconsistent routing and rigid algo frameworks often lead to missed opportunities and unnecessary costs.

The Solution

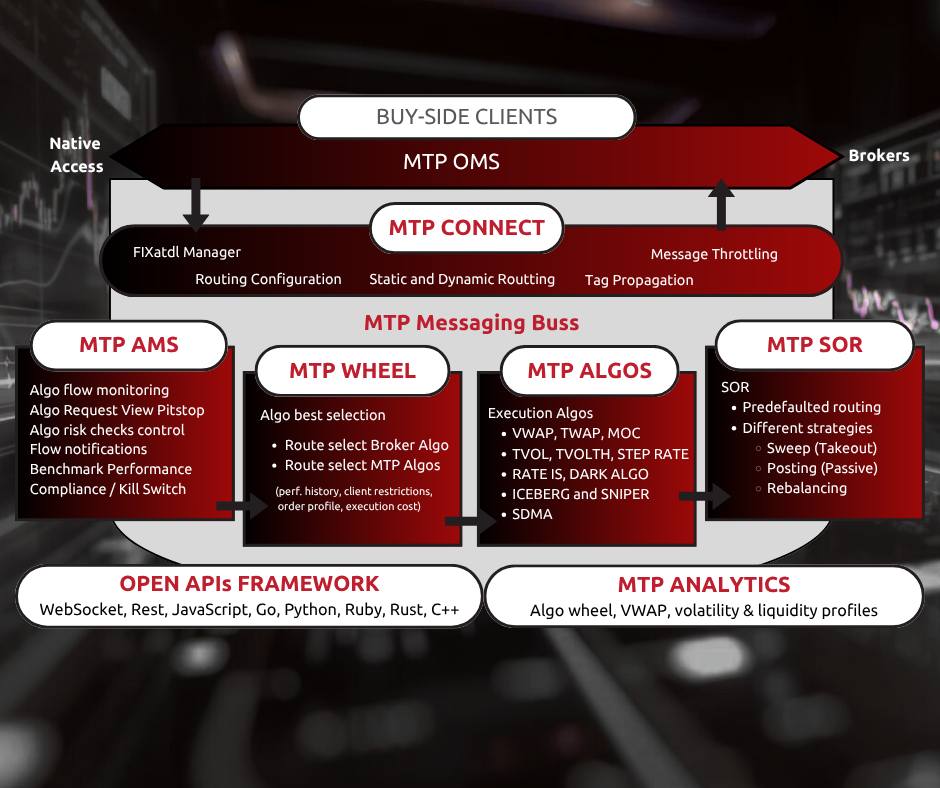

A fully integrated solution: a high-performance connectivity hub combined with a customizable algorithmic trading engine. Together, they streamline market access, automate smart order execution, and give trading desks the control and agility to adapt instantly.

Marvelsoft connectivity hub, MTP Connect, works alongside our execution algorithms and Smart Order Router (SOR) to deliver dynamic control over how, where, and when orders are routed – all driven by execution analytics. As markets and execution venues evolve, this alignment becomes increasingly essential.

What You Get with Marvelsoft’s Integrated Execution Stack

- Customized connectivity

- Rule-based and dynamic routing

- FIX-native, modular architecture

- Low-latency performance

- Schedule-based, Volume-driven, Price Auction, SDMA, DPL, and SOR algos

- Cross-regional routing support

- White-label and customizable strategies

- Implementation shortfall & liquidity-seeking algos

- Real-time monitoring, alerts & risk management

- Algo suite built for precision, speed, and flexibility

Why Connectivity and Algo Engines Must Be Aligned

Marvelsoft’s architecture ensures that connectivity and execution are fully synchronized. Whether you’re using VWAP, TWAP, or ICEBERG, MTP Connect ensures orders reach the right venue at the right time, with minimal latency.

Our algorithms are intuitive and flexible. While users have access to over 450 engine and trader parameters, none are mandatory. Intelligent defaults allow immediate trading out of the box, with the option to fine-tune strategies as needed. Each algo adapts to your trading style instead of forcing you to adapt to it.

What Do Execution Algorithms Need for Optimal and Successful Trading?

To be effective, execution algorithms must adapt in real time, reduce market impact, protect strategy confidentiality, and outperform performance benchmarks.

Marvelsoft’s execution algorithms are built with these priorities in mind. Backed by a real-time market data feed handler, broad venue access, and smart execution logic, our system makes trading faster and more reliable.

Our algorithms help users:

- Manage market impact

- Minimize gaming and reduce strategy disclosure

- Execute large orders while beating market benchmarks

Their effectiveness is further enhanced by:

- A client-server architecture linked to low-latency market data

- Pre-compiled code for faster market entry

- Centralized monitoring and control via the Algo & DMA Monitoring Tool

- Support for both single-order logic and program trading

- Full validation for order accuracy and compliance

This setup gives traders total visibility and control — even in high-pressure, complex environments.

Conclusion

In today’s fragmented, volatile markets, execution quality depends on the liquidity your algorithms can access. No matter how advanced an algo is, its value is limited without access to the right venues at the right time.

Marvelsoft’s smart routing logic is designed to maximize liquidity exposure, helping traders achieve better fills, reduce slippage, and maintain execution quality even in fast-moving markets.

By combining connectivity, execution, and intelligent routing into a single, integrated system, you gain the speed, precision, and flexibility essential for leadership in today’s electronic trading landscape.

Schedule a demo to see our system in action, or contact us to learn more about optimizing your execution workflows.